[Courtesy of Toss]

SEOUL -- A consortium led by the operator of Toss, a popular fintech unicorn, won temporary state approval to launch South Korea's third internet-only bank after an evaluation committee gave good marks on innovative ideas. The new bank's formal service is possible in July 2021 if final approval comes.

The Financial Services Commission, a state financial watchdog, said Monday that temporary approval was based on judgement from an evaluation committee of outside experts that the consortium led by Viva Republica has a strong will to promote financial innovation and is well prepared in all aspects. Viva has presented its vision to focus on individual customers and small merchants.

The third internet-only bank can launch its service in July 2021, FSC financial industry bureau director Yoon Chang-ho said, adding the commission is willing to approve a fourth internet-only bank in the future. There are two internet-only banks, K bank and Kakao Bank, which provide diversified loan services and easy lending to young smartphone users.

Viva has extracted positive assessment for its innovative idea by benchmarking European digital challenger banks, but it failed to secure preliminary approval from financial regulators in May after South Korea's leading financial group, Shinhan, withdrew as a key partner. In October, Viva made a second attempt by forming a new consortium with two commercial lenders as well as foreign and domestic investors.

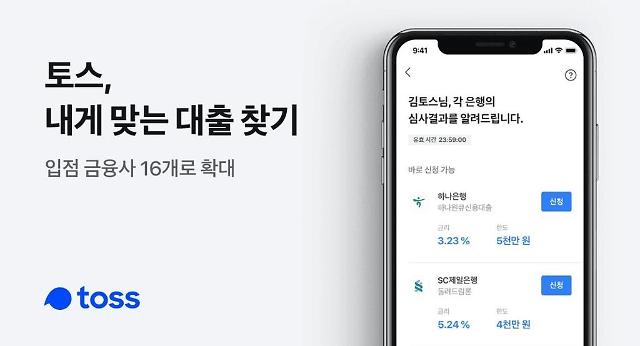

Viva holds a 34 percent stake in the new consortium. KEB Hana Bank, Hanwha Investment and Securities, the Korea Federation of Small and Medium Business and E-Land World, a clothing product retailer, each hold 10 percent, followed by Standard Chartered Bank Korea with 6.67 percent, Welcom Savings Bank with five percent and Korea Electronic Certification Authority (Crosscert) with four percent.

Foreign partners include Altos Ventures, a venture capital firm based in Silicon Valley, Goodwater Capital which invests in Britain's challenger bank Monzo, and Ribbit Capital, the investor in Brazil's challenger bank Nubank.

Viva made its foray into South Korea's digital banking and peer-to-peer payment service with Toss which provided one-stop internet banking and transaction services in February 2015. The simple banking service quickly gained popularity as Toss allows users to access and manage credit, loans, insurance, investment and more from financial service providers.

![[Coronavirus] Epidemic brings about unexpected changes in corporate culture](https://image.ajunews.com/content/image/2020/03/04/20200304172215292619.jpg)